What is Your Investment CAP (Capitalization) Rate?

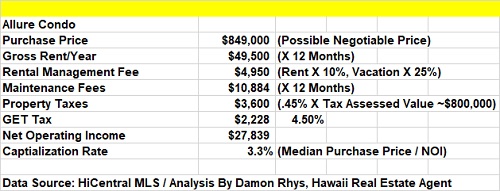

Your CAP Rate would be the yearly NOI (Net Operating Income) on, for example,your investment condo you have rented out after receiving rents for the year and paying out all taxes (property and GET tax), maintenance and management fees. You would then divide this amount by the purchase price you paid for your investment condo to get the CAP Rate. For a simple example, let’s say you purchased your condo for $500K and your NOI for the year was $25K then your CAP Rate would be 25 divided by 500 = 5%. It would work the same for a single family home or apartment building.For an overseas client recently looking for a good investment(s) in the “town” area of Honolulu I calculated the CAP Rates for several buildings. Here is Excel spreadsheet calculation for one of them in the “Allure” building in Waikiki:

Note that if the building in this example was zoned for short term vacation rental or was a condotel the property tax would be 1.29% instead of .45%. In some buildings such as Waikiki Park Heights which is not a condotel but is zoned OK for short term vacation rentals, owner may choose to not run a short term rental and pay the lower property tax of .45%. In that case, a long term rental would also be taxed at .45%. Also, in the case of short term vacation rentals there would be an additional Transient Accommodation Tax (TAT) of 9.25% which is usually passed along to the renter/guest.

As you can see in the spreadsheet example above of the Allure Building the CAP Rate is 3.3%. Please note that if the investor managed the rental himself and passed the GET on to the tenant the CAP Rate would then be 3.9%. Compared to other locations, this may seem a little low (5% could be considered a good benchmark) with the underlying cause being the higher real estate prices in Hawaii. Over the last 30 years the average appreciation rate for single family homes and condos on Oahu has been 4.6% and 4.5% per year respectively. Thus adding 4.5% to the above example of 3.9% = 8.4% would make the proposition in this example look more favorable.

As mentioned in last month’s August Hawaii Damon Newsletter, a condo purchased on Oahu in 1987 for $150,000 at the average per annum appreciation rate of 4.5% would translate to an investment worth $561,197 today. There is no guarantee Real Estate in Hawaii will continue to appreciate at this same rate along with no reason why it would not. However, if it did, a median priced $425,000 condo today (see July 2017 Stats) would be worth $1,591,760 in 2047 (Renters, please take notice!)

Appreciation plays a larger than normal factor in Hawaii Real Estate for investors. Combine that with a CAP Rate of 3% – 4% would make a good investment by almost any standards.

If you are considering investing in a home, condo or condo building in Hawaii for the purposes of generating income, please do not hesitate to contact me, Damon Rhys. I would be more than happy to guide you through the many possible rental income generating properties and their respective CAP Rates that are currently on the market. For more information on this subject please check out my Investors’ Buying Guide – Part IV.

The first part of the Hawaii Damon Newsletter for September covered QT (Quantitative Tightening) and how it could affect the real estate market especially in Hawaii. Please check it out here!

Aloha!

Damon